Mai 2019

Reverse factoring (also known as supply chain finance) is a working capital management tool. It is a structure that offers an affordable and reliable refinancing alternative to a buyer’s supplier base who can request early payment of their approved and validated invoices at a discount and in turn reduce their days sales outstanding (DSOs). The liquidity in such programs is provided by financing parties (mainly banks, in some programs also by non-bank investors) which earn an interest margin on the funding provided. Finally, the buyer can use reverse factoring programs as a means to improve its days payables outstanding (DPO) by renegotiating payment terms with their suppliers. Account Payables And The Risk Of Reclassification

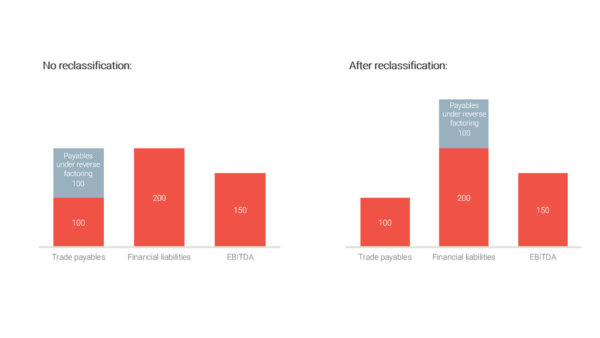

For the buyer to achieve an optimization of working capital, it is considered crucial to ensure that the account payables resulting from buying goods and services from the suppliers remain treated as trade payables on the balance sheet and that a reclassification to bank debt is avoided. The reason for this is that the reclassification to bank debt could outweigh the benefits of reverse factoring as it would increase a buyer’s financial debt and adversely affect the buyer’s leverage and, potentially, loan covenants. The example below illustrates that the net debt/EBITDA ratio of a fictitious buyer deteriorates from 1.33 without reclassification to 2.00 after reclassification.

As an arranger and platform provider of global reverse factoring programs, we are closely following any coverage on the accounting treatment of these programs. The discussion about the reclassification of trade payables has gained increasing attention by market participants and observers and was further fueled by recent high-profile cases of severe misuse of reverse factoring programs (e.g. Carillion, Abengoa).

As a market participant, we believe it is worthwhile to look deeper into the setup of a regular reverse factoring program, especially as proponents of reclassification often focus on cases where the framework shows clear tendencies towards debt-like characteristics. Only recently a case study published by a bank’s research team used a program setup that had many shared attributes of a structured bank loan and only little in common with what the market considers a standard structure for a supply chain finance program.

Before introducing a reverse factoring program, it is therefore crucial that buyers carefully consider the program’s proposed terms and conditions and are aware that substantial changes to the terms of their trade payables, while potentially making the negotiation and execution of the program much easier, are likely to adversely affect balance sheet classification.

While most of the current debate has already been triggered in 2003 by an SEC staffer [1], a key and continued source of uncertainty until today is the fact that current accounting regulations (IFRS and US GAAP) do not provide explicit guidance on the accounting of reverse factoring transactions. However, no market player should pretend as if being forced to act in the dark as some of the leading auditing firms have provided their interpretation of the relevant accounting principles [2] and established a relatively clear analysis framework to at least highlight the absolute no-go areas for the buyers, such as paying interest to the banks or extending the payment terms with the banks rather than with the suppliers. There are certainly more unequivocal differentiators to suggest a reclassification. Moreover, based on our work in SCF and the successful operation of global reverse factoring programs (which implies working with our clients to obtain clearance from their auditors) we believe that there is a market consensus on the key factors that determine the accounting treatment for the related payables.

To determine whether account payables must be derecognized and replaced with financial debt auditors recommend buyers to review certain aspects of a reverse factoring transaction:

In addition to these fundamental questions, auditors have defined some best practices regarding the setup of a reverse factoring program to avoid reclassification in debt:

As outlined above, even though there is currently no explicit accounting guidance in the original IFRS or US GAAP rulebooks, there are accounting manuals and guidelines available from the auditing firms. Moreover, working with experienced partners buyers can apply the best practices and references from the existing programs to work out an SCF program structure that would not jeopardize the accounting treatment of their trade payables.

There is comparably little disclosure in the financial statements of the companies using reverse factoring. The bank research teams that rightfully address the area of reverse factoring typically focus on structures that scream to be reclassified. In our view, this is only a small subset of the market and concluding from it that every reverse factoring program should be considered as bank debt, is misleading. The setup of the supply chain finance programs should rather be examined case by case. In our experience, a proper and carefully crafted program structure leads to a desired outcome in the accounting treatment.

[1] Speech by SEC Staff: Remarks at the 2003 Thirty-First AICPA National Conference on Current SEC Developments, by Robert J. Comerford.

[2] You can search for the relevant key words like accounting for structured payables / reverse factoring online or ask your auditors to share their research.